LCI Monthly – April 2025

- Economy, Global, Investment Strategy, Monthly, Politics

LCI Monthly – April 2025

Key Highlights:

Trump’s Economic Disruption Continues

U.S. President Donald Trump continues to dominate the political and economic landscape with increasingly unilateral and interventionist policies. On April 2nd, he announced sweeping new tariffs on imports from nearly all countries — a move described by analysts as the largest tariff increase in modern history. While some of these duties were later reduced or temporarily postponed, others were raised even further. Notably, tariffs on Chinese imports have reportedly reached 145%, effectively amounting to a near trade embargo.

Federal Reserve Under Pressure

President Trump publicly criticized Federal Reserve Chairman Jerome Powell for not cutting interest rates, escalating concerns about the independence of the U.S. central bank. The perceived political interference triggered a sell-off across U.S. asset classes, including equities, bonds, and the U.S. dollar. However, Trump later clarified that he does not intend to dismiss Powell, which brought some temporary relief to the markets.

Rhetoric Takes an Authoritarian Turn

The President’s tone and actions increasingly reflect autocratic tendencies. In recent speeches, Trump made controversial remarks about annexing territories such as Canada, Greenland, and Panama, and even floated the idea of transforming Gaza into a “Middle East Riviera” under U.S. control. While these comments are widely viewed as provocative or symbolic rather than actionable, they have contributed to global diplomatic unease.

Tesla’s Earnings Slump Sharply – Is More Pain Ahead?

Tesla reported a 71% drop in Q1 2025 net income, with results propped up only by carbon credit sales and secondary business lines. Without them, the company would have posted a loss. Analysts cite declining global brand perception as a key factor, especially in Europe, China, and Canada. This sentiment shift is widely linked to Elon Musk’s political alignment with the Trump administration, which has sparked backlash in several markets. Despite a sharp drop from its $1.54 trillion peak in December 2024, Tesla still holds a market cap of around $915 billion—about ten times more than Volkswagen. In my view, unless the company reverses its current trajectory, there’s significant room for further correction.

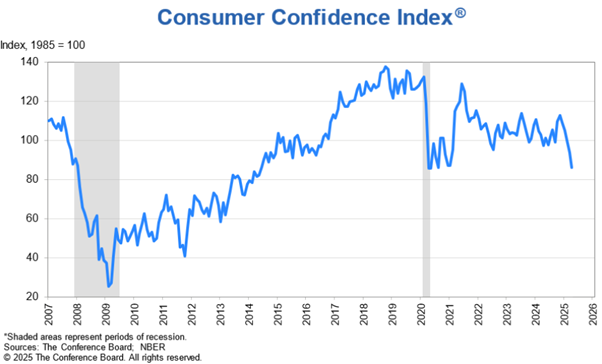

U.S. Consumer Confidence Hits Multi-Year Low

The U.S. Consumer Confidence Index fell to its lowest level in 13 years, reaching levels last seen during the COVID-19 pandemic. Weakening economic sentiment, rising import prices, and heightened political uncertainty are contributing factors.

Equity Markets in April 2025 (Local Currency, USD, EUR, CHF)

Performance LCI Balanced Strategies 2025

LCI Tactical Asset Allocation